We recently asked our customers what trend they were seeing in the insurance and financial services industry, and they overwhelmingly replied that it is the demand for a customer centric business model.

But what does that mean?

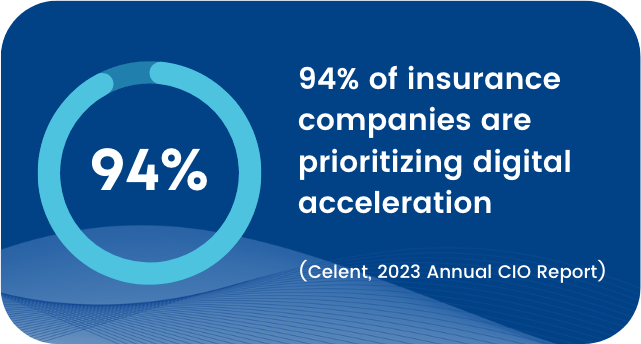

When asked, one customer responded that customer centricity is all about the ease of doing business. To become a customer centric business, it’s important to focus on doing things more easily – for the agent and the customer. According to Celent’s 2023 Annual CIO Survey, life insurance companies are taking note of the changes in the industry – with 94% reporting a focus on the digital acceleration of their business. By digitizing their business, companies can complete tasks with an ease that has previously been unattainable.

Sounds great, right? But how do you accomplish this goal?

The insurance and financial services industry is complex, with many layers and components, and the term “ease” is not one that typically comes to mind when thinking of our industry. How do we change that? Well, let’s look at the components that make up the business to find a way to do each one better, starting with something that affects carriers, distributors, and customers – document delivery.

Manual document delivery is slow. It adds days to the cycle time that, frankly, neither you nor your customer can afford.

It is also expensive: Between the human capital, the paper, and the postage needed to manually deliver a document, your business incurs significant costs.

So how can this process be improved so that it is easier for everyone involved?

e-Delivery allows you to streamline your processes and deliver documents with one simple click. Documents are sent securely to the recipient without postage, paper, or people. With this type of solution, you can not only save time and money, but you can also improve your customer satisfaction due to the ease of doing business with you.

There are several e-delivery solutions in the marketplace, so how do choose what is right for your business?

We’ve assembled a list of questions you should consider when adopting an e-delivery solution:

- What is the cost of e-delivery relative to the cost of delivering documents manually?

- What is the average reduction in cycle time achieved by using e-delivery?

- Can you send a document to multiple people at one time for signature?

- Can you track the progress of a document (received, opened, signed, etc.)?

- What security measures are in place to protect the document and its corresponding data?

As a reference, below we have broken down how iPipeline answers these questions regarding our e-delivery solution, DocFast®.

- DocFast can eliminate delivery costs by 78%*

- DocFast can reduce cycle times by an average of 23 days*

- DocFast allows you to send a document to multiple people with one click

- DocFast uses dashboards that allow you to track when a customer opens, views, comments or e-signs a document

- DocFast employs full document encryption to ensure the protection and privacy of your data

Whatever product or solution you choose to implement, e-Delivery has the power to help you transform the way you do business by focusing on the ease of doing business – for your agents, your customers, and yourself.

To learn more about e-Delivery or DocFast, click here for more information.

*These are average numbers and are not indicative of definite future results.

About the Author

Dennis LaTour is a product enthusiast with over 25 years of experience in the Insurance Industry.

With his long-standing experience in the product management, Dennis loves working directly with the customers on projects and building long lasting relationship. In his free time, Dennis enjoys camping, hiking, and spending time with his family.